import jsonRAG-Enhanced Question Answering for SEC-10K Filings

In this notebook, we implement and test a question-answering system that leverages our optimized RAG retrieval pipeline from the previous analysis. Building on our comprehensive evaluation of retrieval strategies, we now focus on the end-to-end performance of the system in answering specific financial questions.

Our previous evaluation demonstrated that a combination of hybrid search (with metadata filtering) and reranking produces the most effective retrieval results. This approach successfully addresses the challenge of maintaining global context (such as company names and reporting periods) that is often lost during standard chunking and embedding processes.

The question-answering system we develop here follows a straightforward but powerful approach:

- Process a user query

- Retrieve the most relevant document chunks using our optimized pipeline

- Inject these chunks into a carefully crafted prompt

- Generate an answer using a large language model (LLM)

We’ll test this system against our benchmarking dataset of financial questions, which provides a realistic evaluation of the system’s capabilities in extracting and synthesizing information from SEC filing reports.

For this initial implementation, we’ll focus on qualitative evaluation through manual inspection of the generated answers. This allows us to gain insights into the system’s strengths and weaknesses before developing more formal evaluation metrics. While future work will incorporate automated evaluation, it’s worth noting that the retrieval component—which we’ve already rigorously evaluated—represents the critical foundation of the system. Without effective retrieval of relevant context, even the most sophisticated LLM would be unable to provide accurate answers to specific financial questions.

Let’s begin by setting up our question-answering pipeline and examining its performance on real-world financial queries.

Pre-requisites: You need to have run the previous three notebooks before this one. Also make sure that you’ve added your OpenAI API key as an environment variable.

Setup

First let’s import the required libraries and define the best pipeline configuration to use.

The code developed for this section is stored in the src/rag module.

from src.rag.benchmark import display_benchmark_results, evaluate_best_pipeline

from src.rag.chatbot import create_rag_chatbot, rag_with_openaiBelow we set the locations of the pipeline to use, benchmark dataset file, and output directory. For this analysis, we’ll use the retrieval pipeline that produced the best evaluation results. This pipeline consisted of:

- Late-binding chunking with maximum of 200 tokens

- Small embedding model (

bge-small-en-v1.5) - Use of hybrid search and reranking

RUN_DIR = "pipelines/run_20250314_220111/" # Update to match the run directory name created in notebook 3

CONFIG_NAME = "late_chunk200_bge-small-en-v1.5_no_tables/with_reranking_hybrid" # Adjust to your best config

BENCHMARK_PATH = "./data/benchmark/benchmark_dataset_reviewed.json"

OUTPUT_DIR = "./outputs/llm_evaluation_results"Benchmark question answering

Now we’ll run all the questions from the benchmark dataset through the best retrieval pipeline using the evaluate_best_pipeline function. Here we’ll pass the top 20 chunks to the LLM and ask it to answer the question based on this information. For this test we’ll use the OpenAI API.

Note: The gpt-4-turbo model is used below. Change this to gpt-4o-mini if you want to use a cheaper model.

# Run the evaluation with your best configuration

output_path = evaluate_best_pipeline(

run_dir=RUN_DIR,

config_name=CONFIG_NAME,

benchmark_path=BENCHMARK_PATH,

output_dir=OUTPUT_DIR,

model="gpt-4-turbo",

max_tokens=1000,

temperature=0.0,

top_k=20, # Will pass the top 20 chunks to the LLM

initial_retrieval_multiplier=3

)Display generated answers

Below the generated answers are compared to the answers included in the benchmark dataset.

display_benchmark_results(output_path)Benchmark Results Summary:

Model: gpt-4-turbo

Top-k: 20

Number of questions: 9

Total tokens used: 47413

Average processing time: 16.34 seconds

Question 1: d9fd9582-4495-4310-a142-8d3beb5e0d1e

Reference Answer:

Model Answer:

References:

[1] Document: AAPL 2021 SEC Filing (ID: AAPL_2021), Chunk ID: 211cb98e-9903-4d68-ae90-90a4883f2e62

[3] Document: AAPL 2020 SEC Filing (ID: AAPL_2020), Chunk ID: 2046d21a-35e4-411f-8632-a4be21fa967e

Question 2: f8285225-6cf4-4984-b71c-510455c295cf

Reference Answer:

Model Answer:

The potential impacts of these fluctuations on Google's income before taxes for the years 2020 and 2021 were significant. If an adverse 10% foreign currency exchange rate change had occurred, it would have resulted in an adverse effect on income before income taxes of approximately $497 million for the year 2020 and $285 million for the year 2021, after considering the effect of foreign exchange contracts in place [2].

References:

[1] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: ac4ddf68-5362-46bb-9d30-e59444af0433

[2] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: e9838825-d133-48ff-b3a4-9af641d0c017

[3] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: 881c2771-8f45-41ec-b484-b4bf1808357a

[4] GOOG 2021 SEC Filing (ID: GOOG_2021), Chunk ID: 4244f650-4539-478c-b0c6-3f6408c3b81e

[5] GOOG 2021 SEC Filing (ID: GOOG_2021), Chunk ID: ec1387c0-8d13-4523-83ee-a8b8dd87b7ba

[6] GOOG 2021 SEC Filing (ID: GOOG_2021), Chunk ID: c61b0066-6a68-4425-b24a-a7205b7141b9

[8] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: 3a7af559-3840-4919-a21e-b75983f27f44

[9] GOOG 2021 SEC Filing (ID: GOOG_2021), Chunk ID: b86197e6-3c18-42d0-9c01-0164aed27235

[10] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: a7bb584a-c343-456d-acbc-b11d7d72a110

[12] GOOG 2022 SEC Filing (ID: GOOG_2022), Chunk ID: 4e1551a0-483e-416a-9c05-bdb760a6255d

Question 3: 01e2d5d6-6b00-45d1-8657-7e85b859d4b8

Reference Answer:

Model Answer:

1. **Decrease in iPhone Sales**: The most significant factor contributing to the decline in net sales was the decrease in iPhone sales. The lower iPhone unit sales were a major contributor to the overall reduction in net sales [1], [3].

2. **Increase in Other Product Categories**: This decrease was partially offset by increases in other areas. There was a rise in net sales of Wearables, Home and Accessories, driven primarily by higher sales of AirPods and Apple Watch [2], [3]. Additionally, the Services segment saw an increase, primarily due to higher net sales from the App Store, licensing, and AppleCare [2].

3. **Currency Fluctuations**: The weakness in foreign currencies relative to the U.S. dollar had a significant unfavorable impact on net sales in 2019. This currency effect negatively influenced net sales across various geographic segments including Europe, Greater China, and the Rest of Asia Pacific [1], [5].

4. **Geographic Performance Variations**: While there were increases in some geographic areas, these were not enough to offset the decreases in others. For instance, net sales in Greater China and Japan decreased primarily due to lower iPhone sales, despite increases in Services and Wearables, Home and Accessories sales [5].

These factors combined led to the overall decrease in Apple's net sales from 2018 to 2019.

References:

[1] Document: AAPL 2019 SEC Filing (ID: AAPL_2019), Chunk ID: 46ac772e-cb47-421b-a2a8-fbed8ac0d919

[2] Document: AAPL 2019 SEC Filing (ID: AAPL_2019), Chunk ID: a9881923-2fa7-4fee-83f3-e99774105303

[3] Document: AAPL 2019 SEC Filing (ID: AAPL_2019), Chunk ID: c65319f4-ef25-4692-96b0-7d4474907d19

[5] Document: AAPL 2019 SEC Filing (ID: AAPL_2019), Chunk ID: c09d9f31-cf4b-4f72-bdfe-be525c663f45

Question 4: f3f4f98c-c82e-4a68-85a1-de18787135a2

Reference Answer:

Model Answer:

- In 2016, NVIDIA invested $12 billion in R&D since its inception [3].

- By 2017, this investment increased to over $13 billion [2].

- In 2022, the cumulative R&D investment reached over $29 billion [4].

- By 2023, NVIDIA had invested over $37 billion in R&D since its inception [1].

This data indicates a substantial increase in R&D investment over the period, reflecting NVIDIA's ongoing commitment to innovation and development in its field.

References:

[1] NVDA 2023 SEC Filing (ID: NVDA_2023)

[2] NVDA 2017 SEC Filing (ID: NVDA_2017)

[3] NVDA 2016 SEC Filing (ID: NVDA_2016)

[4] NVDA 2022 SEC Filing (ID: NVDA_2022)

Question 5: cf1d017d-b6f2-48e2-b6a0-fad75fec4807

Reference Answer:

Model Answer:

- In 2018, a 100 basis point increase would have resulted in a $4.9 billion decline in the fair market value of the investment portfolio [3].

- In 2019, the impact of a 100 basis point increase would have resulted in a $2.8 billion decline in the fair market value of the investment portfolio [4].

- In 2020, the impact of a 100 basis point increase would have resulted in a $3.1 billion decline in the fair market value of the investment portfolio [1].

From 2018 to 2019, the potential impact decreased from $4.9 billion to $2.8 billion, indicating a reduced sensitivity to interest rate increases. However, from 2019 to 2020, the potential impact increased slightly from $2.8 billion to $3.1 billion.

References:

[1] AAPL 2020 SEC Filing (ID: AAPL_2020)

[3] AAPL 2018 SEC Filing (ID: AAPL_2018)

[4] AAPL 2019 SEC Filing (ID: AAPL_2019)

Question 6: dd218ea8-e6c1-432f-8194-c78beef2c044

Reference Answer:

Model Answer:

From the reported financial commitments, Microsoft excluded several items. Specifically, they excluded long-term tax contingencies, other tax liabilities, deferred income taxes, and long-term pension liabilities totaling $15.2 billion [4]. Additionally, unearned revenue and non-cash items were also excluded from the reported amounts [4][6].

References:

[1] MSFT 2015 SEC Filing (ID: MSFT_2015), Chunk ID: 12f9a3d0-3026-4c1d-9c0c-f19dd8e266c6

[4] MSFT 2015 SEC Filing (ID: MSFT_2015), Chunk ID: 980aac15-7caf-42d2-87f9-ddc38bc3493d

[6] MSFT 2016 SEC Filing (ID: MSFT_2016), Chunk ID: 264bd0cf-58b2-49aa-9a41-2b3a129173d9

Question 7: 5fd570db-db81-4369-8f35-4aa13995654a

Reference Answer:

Model Answer:

References:

[1] Document: GOOG 2019 SEC Filing (ID: GOOG_2019), Chunk ID: f01ad5bc-8207-4a94-901a-4eb33a632560

[3] Document: NVDA 2018 SEC Filing (ID: NVDA_2018), Chunk ID: db204d56-5139-4f88-8a9d-e218d4e93899

Question 8: ed50c67e-ae38-47b7-9983-98e2af1d03eb

Reference Answer:

Model Answer:

The main drivers behind these revenue changes include:

1. **GPU Revenue Growth**: In 2016, the GPU revenue increased by 9% primarily due to growth in GeForce GPUs for gaming and Tesla products for data centers [1]. By 2021, the growth in the Graphics segment was 29%, driven by GeForce GPUs and game console SOCs [3].

2. **Data Center Expansion**: A significant boost in 2021 revenue came from the Data Center segment, which saw a 124% increase. This growth was fueled by the Mellanox acquisition and the ramp-up of the NVIDIA Ampere GPU architecture [2].

3. **Acquisitions and New Technologies**: The acquisition of Mellanox in 2020 significantly contributed to the revenue in 2021, with Mellanox revenue accounting for 10% of the total company revenue [2]. The introduction of new GPU architectures and expansion into new product areas also played crucial roles.

4. **Diverse Segment Performance**: While some segments like Automotive and Professional Visualization saw declines due to specific market conditions such as COVID-19 impacts and shifts in product demand, others like OEM and Other revenue grew by 25% in 2021, primarily due to higher volume of entry-level laptop GPUs [2].

Overall, NVIDIA's strategic acquisitions, expansion into new markets, and continuous innovation in GPU technologies were key factors driving the substantial revenue growth from 2016 to 2021.

References:

[1] NVDA 2016 SEC Filing (ID: NVDA_2016)

[2] NVDA 2021 SEC Filing (ID: NVDA_2021)

[3] NVDA 2021 SEC Filing (ID: NVDA_2021)

[4] NVDA 2021 SEC Filing (ID: NVDA_2021)

Question 9: 7fc75be9-52fa-42f2-ba72-8a0107e5eb42

Reference Answer:

Model Answer:

- In 2017, there were 25,333 shareholders of record [1].

- In 2018, the number of shareholders decreased to 23,712 [5].

- By 2019, the number further decreased to 23,233 shareholders of record [2].

This indicates a gradual decrease in the number of shareholders of record over the three-year period from 2017 to 2019.

References:

[1] AAPL 2017 SEC Filing (ID: AAPL_2017)

[2] AAPL 2019 SEC Filing (ID: AAPL_2019)

[5] AAPL 2018 SEC Filing (ID: AAPL_2018)

Analysis of outputs

Our manual inspection of the RAG-enhanced question answering system reveals promising results with some areas for improvement:

Strengths

- High Accuracy: The system successfully answers all benchmark questions, covering the key details present in the reference answers.

- Comprehensive Responses: Generated answers often provide more comprehensive information than the reference answers, including relevant contextual details.

- Effective Retrieval: The combination of hybrid search (with metadata filtering) and reranking successfully retrieves the relevant context needed to answer specific financial questions.

Areas for Improvement

Some minor issues remain in the generated reponses, which may be the focus in future iterations. These include:

- Year Comparison Precision: When asked to compare specific years (e.g., 2016 vs. 2021), the system sometimes includes data from intermediate years. This is likely due to our metadata filtering approach, which includes the subsequent year to capture reports that might contain relevant information about the requested year.

- Reference Numbering: The current reference numbering system is based on retrieved chunk numbers rather than the order in which they appear in the answer. Implementing consecutive numbering starting from [1] would improve readability and citation clarity.

- Answer Conciseness: While comprehensive answers are valuable, there may be cases where more concise responses would better serve user needs. Future improvements could focus on balancing completeness with brevity.

Next Steps

The next steps may include:

- Refining the metadata filtering approach to be more precise with year comparisons while maintaining recall

- Implement post-processing to renumber references consecutively based on their appearance in the answer

- Consider adding automated evaluation metrics to complement manual inspection

- Explore prompt engineering techniques to guide the model toward more concise answers when appropriate

Overall, the RAG system demonstrates strong performance in answering complex financial questions, with the identified improvements representing refinements to an already effective approach.

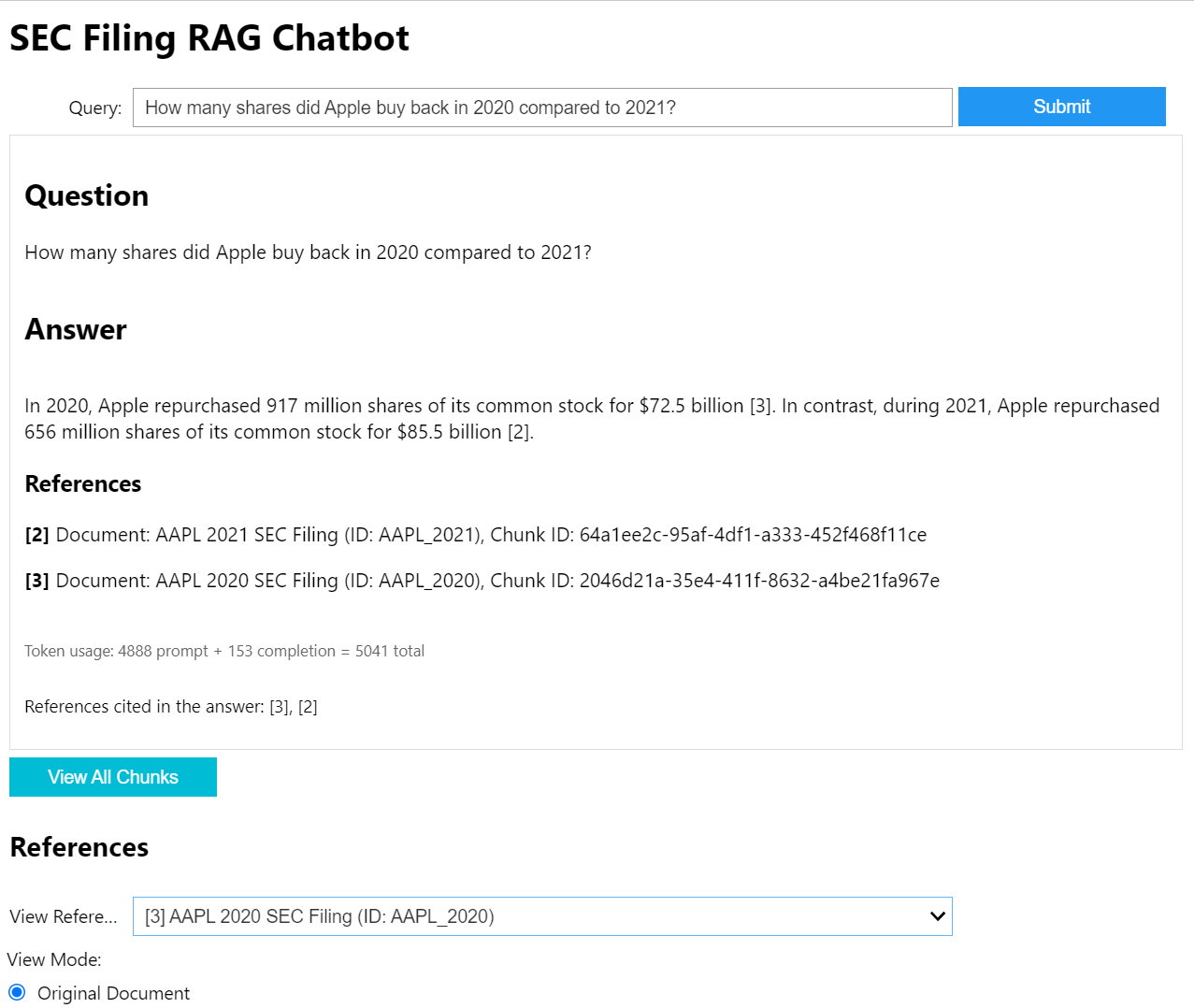

Chatbot tool

A basic chatbot interface that can be run within the notebook is also included. This allows you to inspect the references and check that they are actually from the source document.

create_rag_chatbot(

run_dir=RUN_DIR,

config_name=CONFIG_NAME,

model='gpt-4-turbo',

top_k=20

)

Summary

Overall, the RAG system demonstrates strong performance in answering complex financial questions, with the identified improvements representing refinements to an already effective approach.